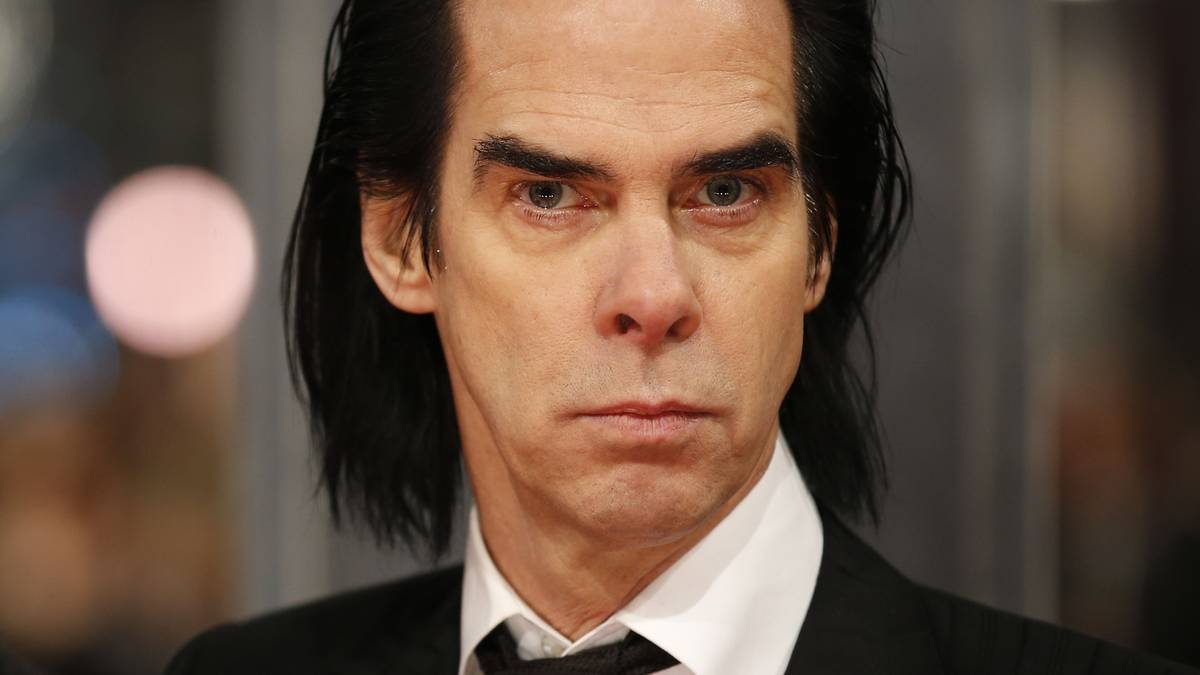

Tesla shareholders have been urged to vote against plans to pay its chief executive Elon Musk up to $56bn (£44bn).

The compensation package, if approved, would be the biggest ever for a chief executive in the US.

However, proxy advisory firm Institutional Shareholder Services (ISS) has warned the amount is "excessive" and said it would not help Musk to "focus" more on the company.

It comes following concerns that the controversial billionaire has become distracted from running Tesla by his other business interests, including SpaceX and X, formerly Twitter.

The electric carmaker has also been hit recently by falling revenue, product recalls and job cuts.

Shareholders will vote on whether to approve Musk's payout at Tesla's annual general meeting on 13 June.

They will also decide whether to reincorporate the company in Texas after a judge in Delaware, where Tesla is officially based, blocked a previous attempt to pay Musk the multi-billion figure.

Other advisory proxies have also recommended that shareholders block the pay amount in the vote, which is being seen by some commentators as a referendum on Musk's leadership of the firm.

The compensation package sets rewards based on Tesla's market value rising to as much as $650bn (£510bn) over the 10 years from 2018. The company is currently valued at nearly $570bn (£445bn).

ISS said in a report that, although the compensation package arguably reflected "the company's significant financial growth," it also "remains excessive, even given the company's success".

The advisers said the amount "failed to achieve the board's other original objectives of focusing CEO Musk on the interests of Tesla shareholders, as opposed to other business endeavours, and aligning his financial interests more closely with those of Tesla stockholders".

ISS said there were also other concerns including "a lack of clarity on the board's plan" for Musk's future pay.

Read more from business:

House prices 'rebound'

Britons put record amounts into ISAs

Boeing blocked from increasing production

Tesla has defended the plans and said Musk had generated wealth for stockholders because he has "skin in the game".

In comments earlier this week, responding to similar criticism, the company said Musk had helped it achieve "performance targets that were regarded by many as extremely difficult or impossible".

It added: "Stockholders should care enormously about value creation.... and not about whether Elon's perceived 'focus' was strong enough."

Please use Chrome browser for a more accessible video player

It comes after the company's quarterly revenue dropped in April for the first time in almost four years.

Competition from China and slowing demand for electric vehicles have been blamed for the recent downturn in the firm's fortunes, along with controversies surrounding Musk.

It came as Tesla announced on Friday a recall of more than 125,000 of its vehicles in the US to fix problems with seat belt warning systems.

Please use Chrome browser for a more accessible video player

US officials said the alerts - which are supposed to inform and remind drivers if a seat belt is not fastened - were not going off as expected and did not comply with safety regulations, raising the risk of people getting injured during a crash.

The National Highway Traffic Safety Administration said the recall included certain 2012-2024 Model S, 2015-2024 Model X, 2017-2023 Model 3, and 2020-2023 Model Y vehicles.

5 months ago

47

5 months ago

47

English (US)

English (US)