Last year was the first since 1870 that bonds and equities both experienced an annual decline, as the interest rate shock destroyed the value of assets in almost all classes.

Investors have been rushing to redesign their portfolios as the style of investing, which had worked so well in the years post-global financial crisis, somewhat fell apart.

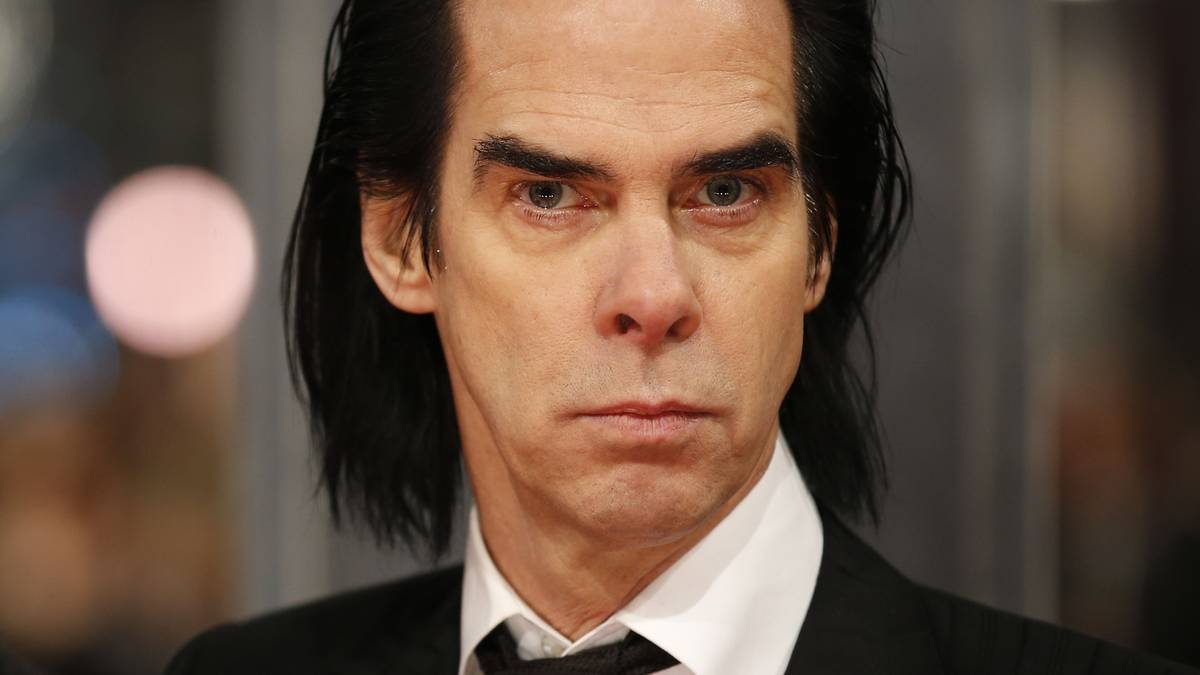

Speaking in interest.co.nz's Of Interest podcast (https://www.interest.co.nz/of-interest-podcasts) , Greg Fleming, head of global diversified funds at Salt Funds, said fiscal and monetary stimulus during the pandemic had created several parallel bubbles which are now deflating.

"We had an extraordinary amount of money sloshing around after Covid triggered that super-stimulus; not just fiscal stimulus but also central bank stimulus."

“That amount of money sloshing around the system had to find a home. Many markets took that money, some as solid as residential property, others as ethereal as ethereum.”

Bubbles in both dependable and speculative markets have been deflating and bringing investment portfolios with them.

Silicon Valley Bank, for example, was at the heart of the venture capital boom which occurred in 2021 as cashed up investors looked for places to invest all the excess liquidity they found themselves holding.

Deposits rushed into the bank as start-ups raised big funding rounds and Silicon Valley Bank invested that cash in treasury bonds.

But it couldn’t last, start-ups stopped depositing money when venture capitalists stopped writing them checks in 2022 and sky-rocketing rates depleted the value of the bank’s bonds.

It's a classic boom and bust story. The economy got too hot, the bank grew too fast, and it imploded when conditions suddenly reversed.

Not all assets and investments have experienced the dizzying extremes that Silicon Valley Bank has, but most have charted a similar direction of travel.

Accident waiting to happen

“If you go back three years, and were constructing a portfolio from scratch, one thing you would see was horrifically expensive bonds everywhere, that looked like an accident waiting to happen,” Fleming said.

“It is almost wearying to see people expressing surprise at the bond meltdown that happened last year, it was always going to happen and was just a question of minimizing your investors' exposure to it.”

The meltdown was the worst bear market in bonds that has ever occurred, which coincided with a bear market in stocks. These two assets have traditionally had an inverse-correlation, meaning one would fall when the other climbed.

That has not been the case in the past year and these two asset types have begun moving in the same direction, posing a challenge to traditional portfolio construction.

It is possible both stocks and bonds could rally when – or if – central banks cut interest rates, extending the correlation between the assets.

This might require investors to look for other uncorrelated assets to smooth out volatility in portfolios. Examples might include infrastructure, carbon credits, or even commodities like timber.

In its quarterly Global Outlook Report, Salt Funds said the approach of building portfolios from hundreds or thousands of individual securities was reliant on broad multi-year market rallies such as occurred after the global financial crisis.

“However, such rallies may now be found to belong to a vanished era, where central banks cushioned or prevented recessions by expanding liquidity and lowering the cost of activity through interest rate suppression”.

With central banks now focused on price stability, and willing to induce recessions to get there, the era of “wave riding investment strategies” may have passed.

“For instance, it is plausible to foresee a phase in which the main market benchmark indices move sideways in ranges, whilst individual securities within them still offer scope for better outcomes.”

Fleming said his expectation for financial markets in the remainder of 2023 was that it won’t be as bad as it might have felt this past week.

“We’re in more of a dilemma than a disaster,” he said. “It is a dilemma because the central banks do have to put a stopper in inflation, but they don’t want to break too many things that are reliant on yields not going through the roof”.

“Be satisfied with the quality and the underlying balance sheet of anything you invest in; be very, very vigilant about that."

You can find all episodes of the Of Interest podcast here. (https://www.interest.co.nz/category/tag/interest-podcast)

.png) 5 months ago

36

5 months ago

36

English (US)

English (US)